Professional Adviser: The road ahead: Trends shaking up the adviser value proposition

Advisers must remain nimble and proactive in evolving their propositions.

Media mention

Professional Adviser: The road ahead: Trends shaking up the adviser value proposition

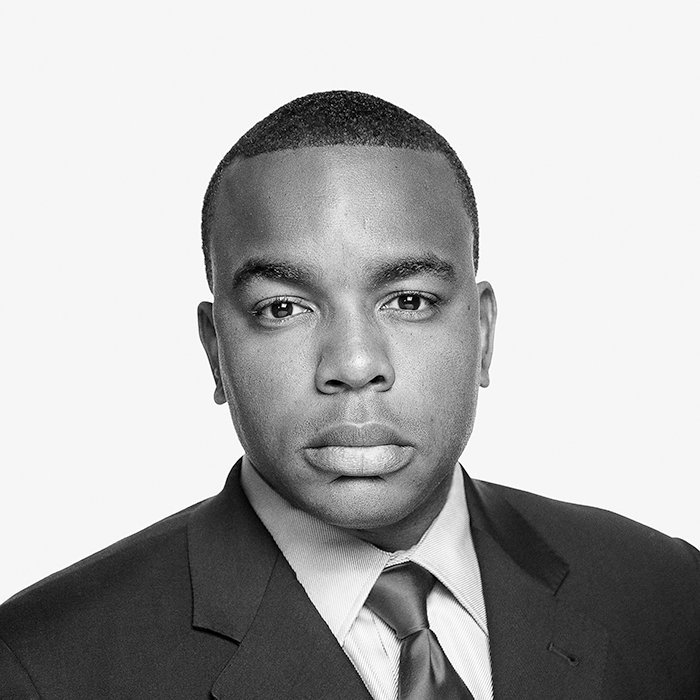

In his latest article for Professional Adviser, J. Womack explores adviser market trends and says IFAs must adapt and evolve to meet their clients' changing needs and concerns.

The financial advice landscape is becoming increasingly complex for both advisers and investors. In this turbulent economic climate, what investors truly need is a connected and personalised experience to navigate these stormy waters and reach their long-term financial goals.

In our fast-paced, increasingly digital world, information is at everyone's fingertips, and this shift demands a transformation in how advisers approach their business models. They must adapt and evolve to meet their clients' changing needs and concerns.

As we step into the new year, advisers must keep three key trends at the forefront of their minds.

Prolonged market volatility

The ongoing volatility, coupled with the cost of living crisis and soaring inflation, continue to trigger impulsive financial decisions. This tumultuous market environment has left many investors wary, leading some to withdraw their investments entirely. In these times, the role of financial advice becomes pivotal in steadying the investors' emotional responses, allowing them to stay focused on their long-term objectives.

Advisers must guide their clients through these choppy waters, highlighting various options and opportunities that these market conditions can present.

During these volatile periods when investors' emotions may be running high, it's common for unconscious biases like loss aversion and recency bias to surface in adviser-client interactions.

Rather than sidestepping the issue of behavioural biases during times of volatility, advisers should create an open dialogue about these biases and their potential impact on their clients' long-term financial goals.

Addressing these concerns places advisers in a strategic position to steer their clients towards more informed and beneficial decisions.

The choice paradox

In today's environment, where personalisation is key, the abundance of investment options can be too intense for investors. This paradox of choice requires advisers to find the delicate balance between providing a tailored, goals-based wealth management experience and overwhelming them with too much choice.

This scenario presents an opportunity for advisers to streamline their offerings to enhance their value and coach their clients effectively. Advisers must articulate how each client's portfolio aligns with their financial goals, navigating them through the myriad of choices and recommending paths tailored to their individual needs. By focusing on these areas, advisers can significantly contribute to their clients' long-term success and improve their overall financial wellbeing.

Tech as an enabler

The tech revolution isn't slowing down. Investors expect a comprehensive, on-demand financial overview, placing a significant digital transformation imperative on advisers. To remain competitive and relevant, advisers must harness technology to create a unique and personalised client experience. Access to real-time information, underpinned by a modern technology infrastructure, is key to connecting investors to what matters most to them, whenever and wherever they want it.

The growing adoption of open banking is further empowering advisers, enabling greater operational and compliance efficiencies, as well as automation. As advisers adopt and deploy these tools to gain deeper insights into their clients' individual financial situations, this additional knowledge of a client's positions in retirement savings, creditworthiness, account balances, and spending patterns provides a more holistic view of their financial lives—enhancing the value that advisers can provide.

The road ahead

As we face ongoing economic uncertainty, the new year calls for advisers to remain nimble and proactive in evolving their propositions to align with their clients' needs. Advisers must coach their clients through these challenging conditions, helping them to adapt and navigate the ever-changing financial landscape.

Those who successfully embrace and leverage these trends stand to not only enhance their clients' financial outcomes, they can also drive substantial growth for their businesses as clients begin to differentiate between advisers who can provide a modern, hyperpersonalised experience and those that cannot.

Important Information

Information provided by SEI Investments Management Corporation. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results.