Thought leadership

Sustainable investing at SEI – our approach

If you think ESG (environmental, social and governance) is an overused acronym that has lost all meaning, perhaps a more structured approach can bring it to life.

Sustainable investing at SEI – our approach

Investors increasingly demand a more pragmatic focus on the ESG impacts of their investment portfolio – in short, they require their investment to do well, while doing good.

Sustainalytics, our best-of-breed engagement provider, has assets under engagement of €2.5 trillion1. This gives us a clear voice when it comes to representing our primary investment objectives, as well as the manner in which they are achieved.

Given its present ubiquity, you could be forgiven for thinking ESG was a 21st century phenomenon, but SEI ran its first dedicated ESG mandate in 1992. Traditionally, we have found the ESG spectrum has returns-only at one end, and outright philanthropy at the other. Pension scheme trustees are duty-bound to put the financial interests of their members first, so necessity dictates an approach somewhere in the middle. Our manager research process helps bridge the gap.

Claiming the middle ground

We assess asset managers using our proprietary ESG scoring system, which looks at how sustainability risk is integrated within the manager’s investment process. We task managers with considering both financially material challenges and opportunities within the context of investment stewardship. No minimum threshold has been established with respect to these capabilities in order for a firm to be hired as a Portfolio Manager. Rather than simply excluding companies, we prefer to shape investment practice by engaging positively.

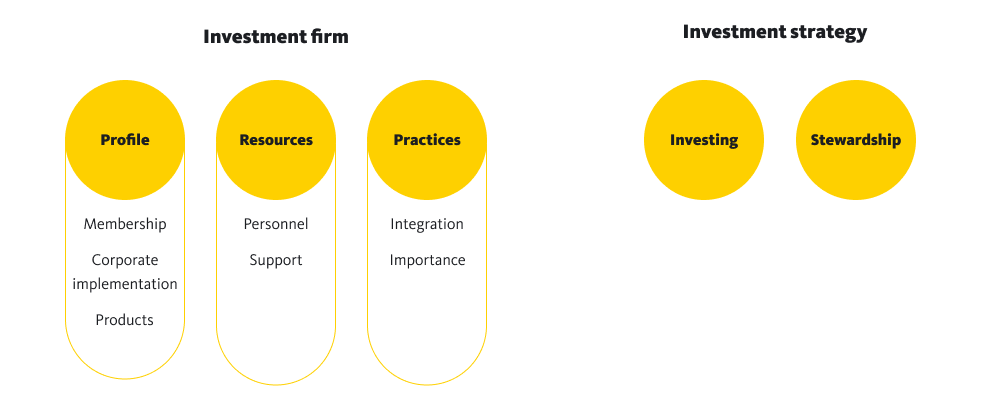

For each of the strategies considered on our investment platform, clients can see managers graded as Strong, Moderate, Limited or Weak. This scoring system is based on the following firm-level and strategy-level themes: profile, resources, practices, investment process, and stewardship approach.

Integrating sustainability in manager research

By assessing a manager’s commitment to sustainable investing, we can establish its priority and longevity at the firm in question, which gives us a profile.

We also interrogate whether or not a manager is equipped to deliver on their stated ESG objectives by undertaking a thorough audit of the manager’s resources. Will words lead to actions?

This goes hand in hand with assessing how a manager integrates sustainability into their investment process. Examining a manager’s practices gives clients a clearer view of whether or not they are seeing the genuine article or simply “greenwashing”.

And then the extent to which ESG factors are incorporated at every stage of the investment process, from portfolio construction to data quality, informs our view of the manager’s strategic investing approach.

Finally, our consideration of stewardship looks at reporting capabilities, as well as the intensity and thoughtfulness of management engagement.

Source: SEI As of December 31, 2021. Subject to change without notice.

Monitoring and measuring the many moving parts of sustainable investment is wide-ranging and complex, but our manager research helps clients to form a more insightful and balanced view.

1See full report for more details. Source: Sustainalytics, Stewardship Services p.4. As at 31 January 2022.

Our approach to sustainable investing

We're deeply committed to helping our clients meet their priorities and goals.

Our sustainability insights

Important Information

This is a marketing communication

This webpage contains marketing material about our fiduciary management services. This webpage does not present impartial advice on this service. In certain cases, you are required to conduct a competitive tender process prior to appointing a fiduciary manager. Guidance on running a tender process is available from the Pensions Regulator.

While considerable care has been taken to ensure the information contained within this webpage is accurate and up-to-date and complies with relevant legislation and regulations, no warranty is given and no representation is made as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

Sustainability guidelines may cause a manager to make or avoid certain investment decisions when it may be disadvantageous to do so. This means that these investments may underperform other similar investments that do not consider sustainability guidelines when making investment decisions. There can be no assurance goals will be met. If a product or strategy is subject to certain sustainable investment criteria it may avoid purchasing certain securities when it is otherwise economically advantageous to purchase those securities, or may sell certain securities when it is otherwise economically advantageous to hold those securities. Sustainability is not uniformly defined and scores and ratings may vary across providers.

SEI considers ESG factors as part of its Portfolio Manager Research and due diligence process including an evaluation of each Portfolio Manager's approach to integrating sustainability risk in its investment process; however, no minimum threshold has been established with respect to these capabilities in order for a firm to be hired as a Portfolio Manager.

Copyright 2023 Sustainalytics. All rights reserved. This document contains information developed by Sustainalytics. Such information and data are proprietary of Sustainalytics and/or its third-party suppliers (Third Party Data) and are provided for informational purposes only. They do not constitute an endorsement of any product or project, nor an investment advice and are not warranted to be complete, timely, accurate or suitable for a particualr pupose. Their use is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers.

Past performance does not predict future returns. Investment in SEI funds are intended as a medium to long-term investments. The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested. This webpage and its contents are for Institutional Investors only and not for further distribution.

SIEL, 1st Floor, Alphabeta, 14-18 Finsbury Square, London, EC2A 1BR is authorised and regulated by the Financial Conduct Authority (FRN 191713).