Market commentary

SEI Forward

The third quarter prepared investors well for the upcoming Halloween season as several pivotal events heightened uncertainties regarding the direction of the economy.

Third quarter SEI Forward

Trick or treat?

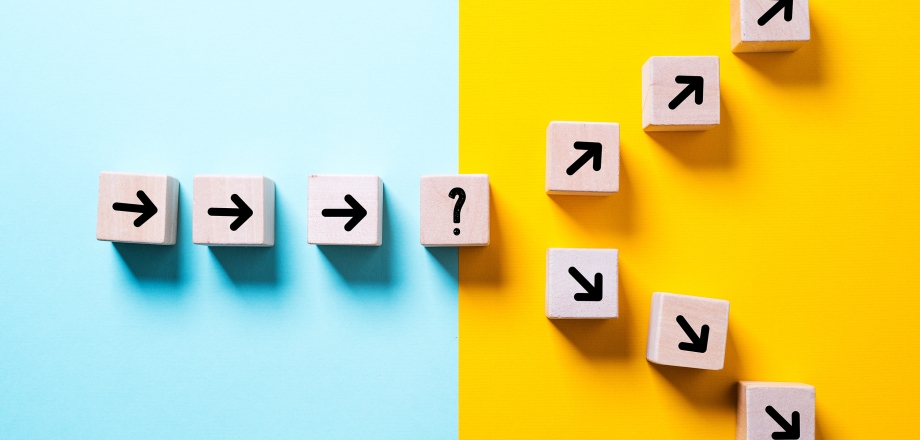

The third quarter prepared investors well for the upcoming Halloween season as several pivotal events heightened uncertainties regarding the direction of the economy, geopolitics, and capital markets. Will central banks deliver the treat of a soft landing, or will subsiding inflationary trends prove to be a temporary trick as stimulus measures and spreading geopolitical tensions act as catalysts for a reversal? Is broadening equity market performance a reflationary treat as the global economy remains robust and financing rates fall, or just the trick of a short-term junk risk rally? Finally, will long-term interest rates treat investors by following short-term rates lower or will the summer rally prove to be just a trick upended by overly simulative monetary policy and every increasing debt levels?

As we enter the final quarter of 2024, the world’s two largest economies are handing out plenty of sweets in the form of easing monetary policies and a broad range of fiscal stimulus measures that should provide ballast to the global economy. U.S. Federal Reserve (Fed) policy-makers delivered a somewhat surprising 50-basis point interest rate cut in September. It is likely to be followed by an additional 50 basis points of easing by year-end. Reductions in the federal funds rate, particularly of this magnitude, are typically accompanied by a decline in gross domestic product (GDP) and rising credit spreads.

This pivot to lower rates, however, comes at a time when third-quarter GDP is tracking at roughly 3%, stock markets are at all-time highs, and credit spreads are near all-time lows. Therefore, while we are not overly concerned with a bit of monetary policy stance adjustment at this point in the cycle, the market’s expectations for more than 200 basis points of additional cuts into 2025 seems, frankly, out of touch. Inflation remains well above target, and employment is showing signs of slack relative to the recent historically tight levels. Long story short, too much candy can be bad for the economy. We see a policy mistake brewing that should provide a short-term boost to risk assets, but also upwards pressure on long-term interest rates.

Important information

Index returns are for illustrative purposes only and do not represent actual investment performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results. Diversification may not protect against market risk.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. All information as of the date indicated. There are risks involved with investing, including possible loss of principal. This information should not be relied upon by the reader as research or investment advice, (unless you have otherwise separately entered into a written agreement with SEI for the provision of investment advice) nor should it be construed as a recommendation to purchase or sell a security. The reader should consult with their financial professional for more information.